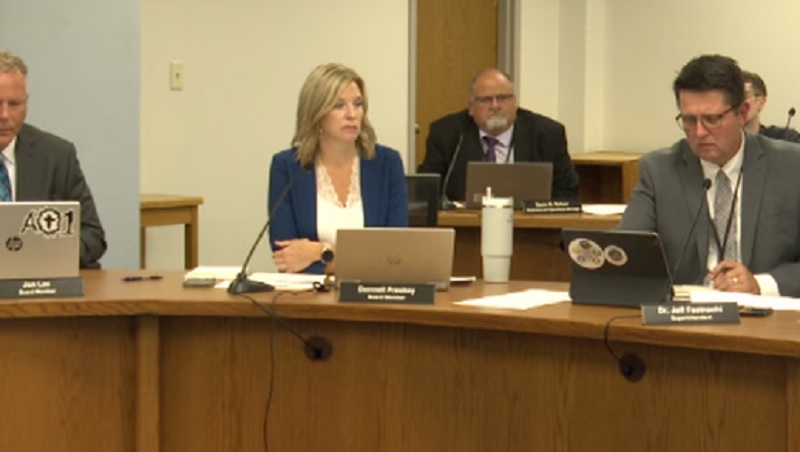

Bismarck, North Dakota – The preliminary budget for the 2023–2024 academic year was approved by the Bismarck School Board on August 8. The mill rate that was suggested was 107.19, the same as it was the previous year. However, households may be paying more due to rising property values.

Property taxes in Bismarck are estimated to cost homeowners $482 annually for every $100,000 of assessed value.

Approximately twenty percent of the BPS budget is allocated to property taxes. Government and state funds cover the remaining amount.

“You want to give living raises to your staff, I’m not sure how you’re supposed to do that without any type of increase. The money’s got to come from somewhere. So, if you want to think, if we get additional students, we need additional teachers, you know, you’ve got to somehow figure out how to pay for them,” said Darin Scherr, business and operations manager for Bismarck Public Schools.

The latest mill levy increase was made six years ago in order to improve Bismarck schools.

“The board decided to reduce class sizes. So, they added a considerable number of staff to be able to do that. And then we also did some money for kind of school-based mental health programs to really get our kids some help in that arena. So those are probably the last two increases years ago,” said Scherr.

Says he, staff salaries account for $180 million of the $200 million budget.

“Everybody from a classroom teacher to a custodian to aides in the classroom, all that consumes the majority of the budget. There isn’t anything we can do. If we need to cut taxes, you’re not going to be able to cut pens and paper, you’re going to have to cut staff,” said Scherr.

You can review the tentative budget here.

The budget is due to the county by October 10 and will be revisited by the board at their October meeting.